Now that we de-mystified what PMF is and how to go about finding it, Part 3 of this series focus on how to know you have it aka how to measure it.

This article leans extensively on the work of Lenny Rachitsky who runs a super informative and entertaining podcast and newsletter on product management. Check it out!

You can always feel when product/market fit isn’t happening. The customers aren’t quite getting value out of the product, word of mouth isn’t spreading, usage isn’t growing that fast, press reviews are kind of “blah”, the sales cycle takes too long, and lots of deals never close.

And you can always feel product/market fit when it’s happening. The customers are buying the product just as fast as you can make it—or usage is growing just as fast as you can add more servers. Money from customers is piling up in your company checking account. You’re hiring sales and customer support staff as fast as you can. Reporters are calling because they’ve heard about your hot new thing and they want to talk to you about it. You start getting entrepreneur of the year awards from Harvard Business School. Investment bankers are staking out your house. You could eat free for a year at Buck’s.

— Marc Andreessen, Co-Founder and General Partner at a16z

This quote is vivid.

And it points out to the fact that, if you are asking whether you have PMF, you probably don’t. As in, you don't feel it. And you wish you can add a yet at the end of this sentence.

But I don't like this focus on feel. I love emotions and have been praised in the past for being an open book, or openly sharing them. But when it comes to deciding to take an investment or hire someone on my payroll, I want more than a feeling.

If you are like me, then keep reading. I introduce qualitative and quantitative indicators of PMF both for the pre- and post-product cases.

Pre-product

If you don’t have a product yet, you will have to do with a more qualitative approach. Below some indicators to look after.

Pull from the market

Product-market fit is a massive pull from the market.

— Patrick Vlaskovits, author of The Lean Entrepreneur

Other entrepreneurs have described it as a “getting pressed into the back of your seat by a fast car or a plane taking off”.

Visible excitement of your customers:

“You have very strong customer feedback, even from a small group of people. For example, at Color early on, we were getting literal love letters from customers.”

— Elad Gil, co-founder of Color Genomics

People willing to pay for the product already now

“Why won't you take my money?”

This is the dream. People begging to pay you for the opportunity to use your product.

Have them sign up for trials and go til the expiration of the trial. If applicable, don’t only ask if they would pay, but invoice them already.

Word-of-mouth spread happening

“Do any users love our product so much they spontaneously tell other people to use it?”

— Sam Altman, Co-Founder and CEO at OpenAI

According to Altman, answering this question pre-growth is the “critical ingredient for companies that do really well”.

“Organic growth is the key indicator of product/market fit. (…) If they love your product, they will tell people about it. Ideally more than 50% of your new accounts come from direct or organic traffic.”

— Merci Victoria Grace, Investor and Product Leader

Post-product:

If you already have a product, then you can and should go a bit more quantitative.

Top-line growth: users want to sign up

Depending on you segment, you want the top of the funnel filling up constantly and your new user metrics growing.

“For consumer apps, you start to experience ‘exponential organic growth’, driven by word of mouth.”

— Andy Rachleff (starting at 3:00), Co-Founder and Executive Chairman at Wealthfront

“Are people grabbing the product out of your hands saying I want it, or I'm using it, or I'm buying it, or I’m downloading it, or I'm giving you my email address.”

— Steve Blank

Run the product-market survey

The PMF survey is a simple question:

“How would you feel if you could no longer use this product?”

— Sean Ellis, Entrepreneur, angel investor, and startup advisor

The multiple-choice answers being something along the lines of "very disappointed", "somewhat disappointed", and "not disappointed".

After benchmarking nearly a hundred startups, Sean Ellis found that the magic number for product/market fit was 40%. Companies that struggled to find growth had less than 40% of users respond “very disappointed”. Companies with strong traction almost always exceeded that threshold.

This indicator is easy to deploy but has one limitation: it relies on what people say instead of what people do. To correct for this, you need some indicators based on usage data. See below.

Retention metrics: users stick around

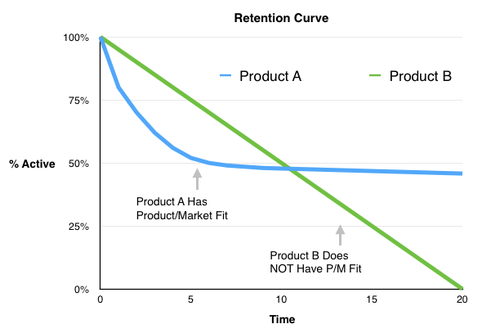

- A flattened off retention curve

“Plot the % active users over time (for various cohorts) to create a retention curve. If it flattens off at some point, you have probably found product/market fit for some market or audience.

— Brian Balfour, Founder/CEO of Reforge

Common wisdom states that retention rates around 20% are a good indicator of PMF. You want to pair this with low churn rates, that indicate that your customers stick around after signing-up.

- Do some cohort analysis

“Long term cohort retention is the best metric for determining if there is product market fit. Once you have a few cohorts that level off at a vertical-specific number, then you’ve achieved product market fit!

— Jeff Chang, Head of Growth Engineering at Whatnot

Cohort retention should flatten out horizontally at some point. This means that a share of your customers find your product attractive enough to keep using it.

Active usage

Ideally, you not only want users to come back but you want them to take meaningful action.

If you are a social media platform, a meaningful action would be to share pictures or content. If you are note-taking app, it would be the amount of characters written, etc. Find the metric that is meaningful for your product and track it.

Cost efficient growth

You don’t want to have to spend too much money in attracting new users. The two metrics below give you guidance on this_

- CAC<LTV

“You have found product/market fit when you can repeatably acquire customers for a lower cost than what they are worth to you.”

— Elizabeth Yin

This metric is most relevant, if you rely on paid channels to attract your users. You need to reliable acquire them for less than they bring you over their life time.

- Burn multiple = Net burn / New ARR

The higher the burn multiple, the more money a startup is burning to achieve a unit of growth. A lower multiple indicates a more efficient growth. This indicadot is meaningful to compare different companies against each other.

Lastly…

This process never ends because your market never stays still. If you have it, grab it and do your celebratory dance. You are on top of something.

👉 If you’re seeing my newsletter for the first time, and you find useful please suscribe.

👉 If you know someone who would benefit from this article, please share it with them!